Imagine completing all of your degree requirements, being in good academic standing, and your family is ready to come celebrate you, but then, you have an e-bill that you and your family cannot handle.

This is the reality for many graduating seniors at N.C. Central University. It is no secret that college tuition is high. The average cost for an out-of-state student attending NCCU is roughly $37,268, according to a 2023-2024 Student Accounting document on tuition and fees.

“Being a first-generation college student coming in, I didn’t know a lot about loans or even how to get scholarships,” said Zionna Lilly, a political science sophomore. “Even coming in with a good GPA and being in the honors program, I haven’t been offered a lot of money.”

An anonymous foundation offered a solution and gifted NCCU with a two-year grant worth $750,000 to create micro-grants to help graduating students with unpaid tuition.

Dr. Kimberly Phifer-McGhee, assistant vice chancellor for Extended Studies and Student Support said her department received a call from the Institutional Advancement department informing them of an anonymous donor offering to “assist the university with helping students graduate.”

Some micro-grants were dispersed in December 2024 due to a special request from the university, but the official cycle begins in Spring 2025. The Office of Academic Affairs plans to disperse funds in every semester until the two-year gift is gone.

Haylee Sanders, a broadcast media senior, said she appreciated the opportunities NCCU has given her, including this grant, because it gave her a positive outlook on graduation.

“I had to transfer out to an in-state school for a year during my sophomore year that my family and I could afford,” the South Carolina native said. “I realized that Central was worth the money because we have way more access to gain skills, internships and just expand our horizons overall.”

Dr. Phifer-McGhee and Dr. Sharon Oliver, the associate vice chancellor for Enrollment Management, analyzed NCCU student data and created a simple application that is sent out to students who are on the verge of graduating, but have a leftover balance.

“What we’re planning to do in the next couple of weeks is send an informative email out to all prospective May 2025 graduates to let them know this is available,” Phifer-McGhee said, adding that they can apply for assistance.

The application process is completed online. It asks for demographic information and why a student may need the grant. Students are also required to complete a money management LinkedIn Learning course and attach the certificate to their application.

“When the applications come in, Dr. Oliver and I review them and decide on the amount,” said Dr. Phifer-McGhee. “In the Fall we had students who needed $100 all the way to $10,000, but the max we can give is $2,500 per student.”

One of the biggest fears for students is paying off the debt from school, if they aren’t so lucky to receive scholarships or grants.

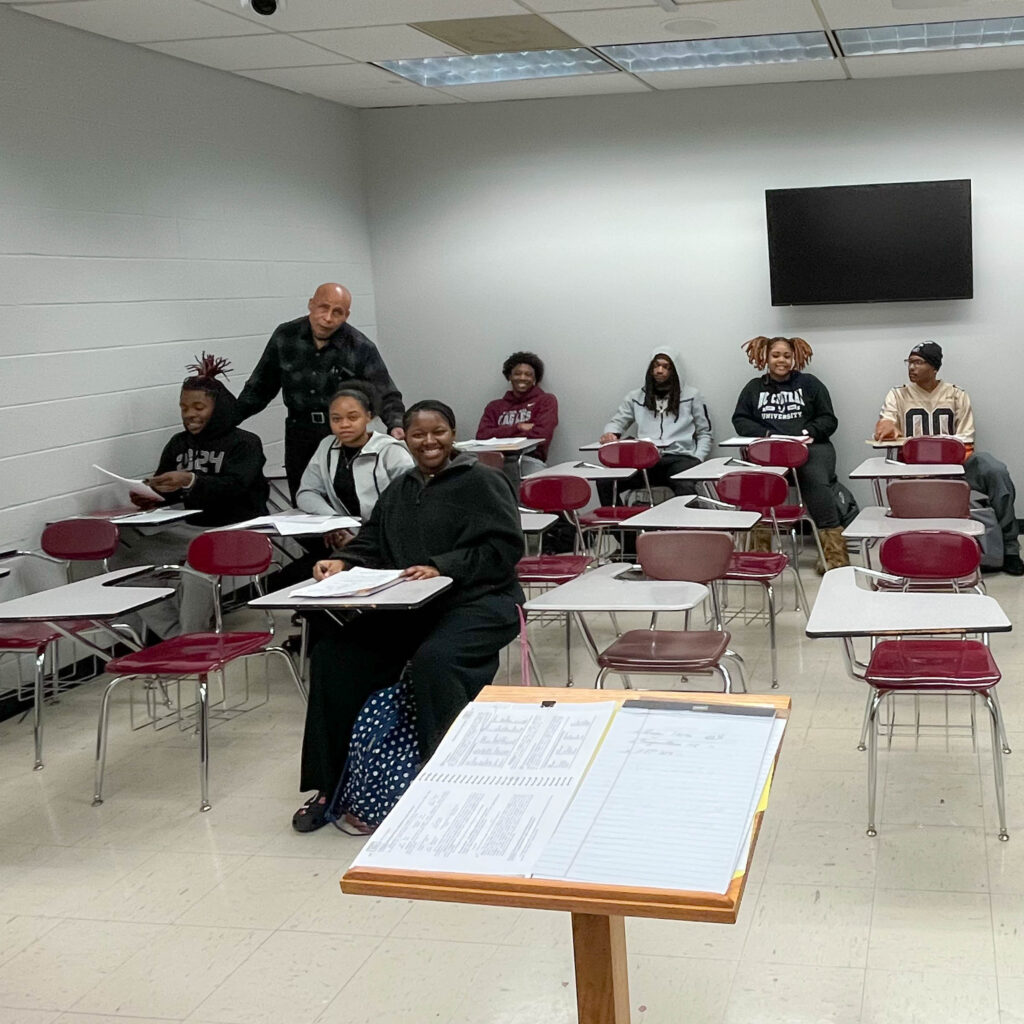

“At first, I was worried about life after graduation because you have to pay back loans you didn’t pay while in school,” said Shahim Faircloth, a theater production senior. “But getting part of this grant would be a peace of mind knowing my debt would be a lot less.”

While the anonymous gift is only available for two years, Dr. Phifer-McGhee said she has high hopes that upon sharing their data with the generous foundation, they will be inclined to extend the gift for years to come.