Eight years ago 35 Campus Echo staffers pooled $75 to begin making loans to impoverished individuals around the world using Kiva.org. Now and again a few dollars have been added to the Campus Echo’s Kiva fund. Loans have been repaid and then relent. In all $650 has been relent to other individuals in the underdeveloped world to finance their small businesses.

Kiva, which was founded in 2005, is a non-profit organization that connects people from around the world through micro lending and microfinancing.

Microfinancing is a term used to describe small finances, small loans, and small savings given to people of low income who do not have access to banks.

Kiva gives individuals and organizations, such as the Campus Echo, an opportunity to pool their money and lend it interest free to people in need worldwide.

Kiva is a Swahili word meaning “agreement” or “unity.”

“Kiva is all about connecting people,” Kiva founder and CEO Matt Flannery said. Every dollar lent through Kiva goes to the recipient of the loan.

Kiva provides loans through microfinance institutions on five continents and 83 countries to individuals that don’t have access to a banking system. The loans are administered locally through their “field partners” and their 450 volunteers from all around the world.

In a 2007 Campus Echo story about Kiva it was reported that the organization had facilitated $12 million in loans from 127,000 lenders. Today, Kiva has facilitated more than $760 million loans from 1.3 million lenders with a 98.5 percent repayment rate. In all, Kiva has made 1,344,397 small loans.

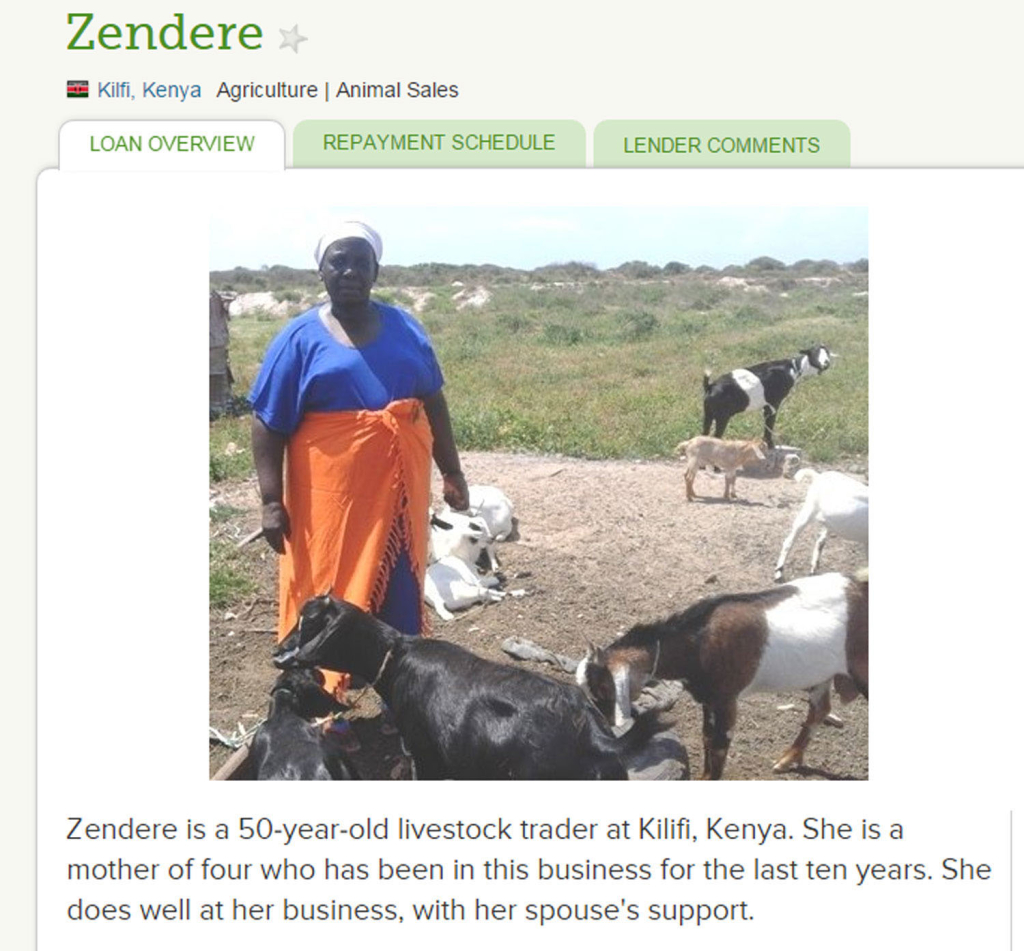

The first small loan the 35 Campus Echo staffers made went to a Jeremiah Miruka, a Kenyan living outside of Nairobi. In all, about $1,000 was pooled together to help him expand his hardware shop.

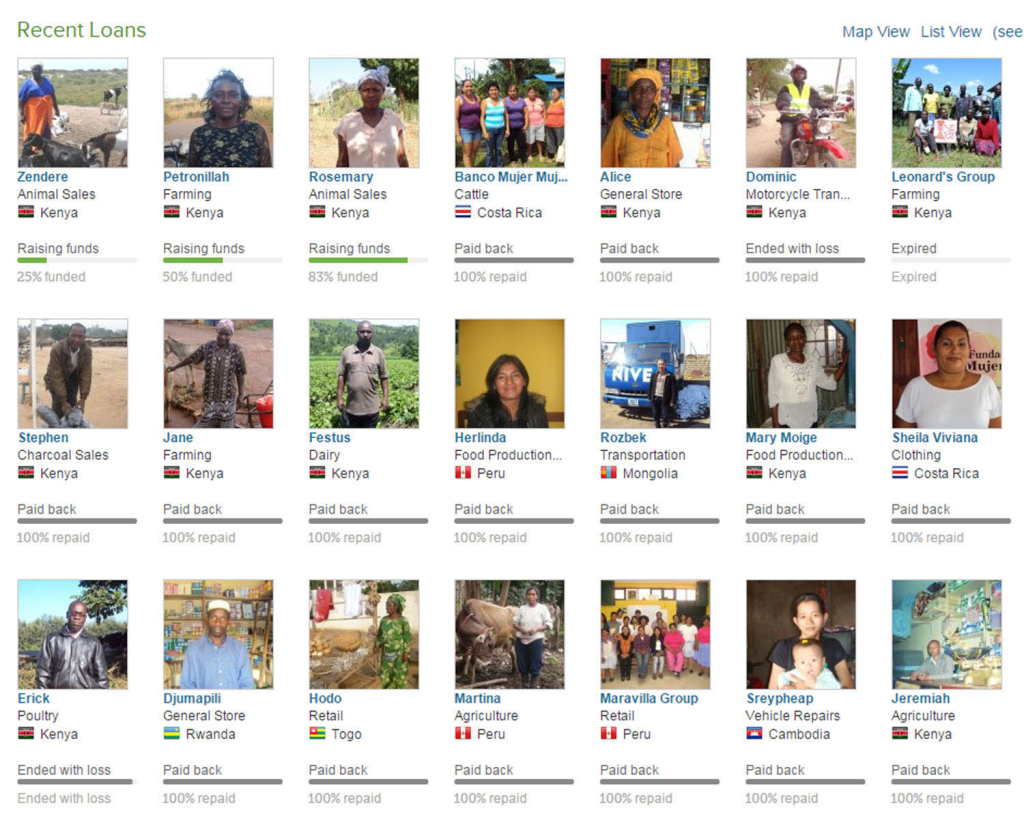

The Campus Echo has now made 21 small loans since 2007 to individuals and groups in seven countries, including Cambodia, Peru, Costa Rica, Kenya, Rwanda, Mongolia and Togo.

“We were going to write a story about Kiva itself, and then we thought it would be fun to make donations, to do loans and go through the process, just to understand it,” said Bruce dePyssler, Campus Echo adviser. “We’ve just kept it going year after year.”

“It’s good to get the students in there. I like to get the students to pick out who we’re going to loan to. So it’s kind of good for them to see what people are dealing with in the underdeveloped world,” dePyssler, who has lived and or done research in the Philippines , Puerto Rico, India, Africa and Mexico.

“In a lot of these countries, if they borrow money locally from a loan shark, they’re paying 50 percent interest. It’s ridiculous, and they end up in debt.” dePyssler said that he lived with a family in India whose lives were being destroyed when a family member took out a tiny loan with a huge interest rate from a loan shark.

Another loan the Campus Echo made helped a man named Rozbek from Mongolia. He used his total loan of $2,475 to fix a truck he uses for his transportation service. He also bought seeds for his vegetable planting business.

Kiva funds are disbursed to borrowers through local field partners that charge small fees to administer the loans locally. Each field partner is given ratings according to the default and delinquency rates on the loans they make. As loans are repaid the funds are deposited in the Kiva account and Campus Echo staffers can relend the money.

Microfinance programs have changed the lives of many in the underdeveloped world, especially poor women, according to the Consultative Group to Assist the Poor, a global partnership of 34 leading organizations that seeks to advance financial inclusion. Of the 21 loans the Campus Echo has made 13 have been provided to women.

According to CGAP.org, qualitative and quantitative studies have documented how access to financial services has improved the status of women within the family and the community. Women have become more assertive and confident.

In regions where women’s mobility is strictly regulated, according to CGAP, women have become more visible and are better able to negotiate the public sphere. Women own assets, including land and housing, and play a stronger role in decision making.

In some programs that have been active over many years, there are even reports of declining levels of violence against women, according to CGAP.

One woman the Campus Echo made a loan to was Mary Moige Ongubo, a Kenyan living in Kahawa. Ongubo used her entire $725 loan to buy cereal and feeds for her small poultry business.

“One of the main problems with poverty is you don’t have any capital. You don’t have anything to do anything with,” said dePyssler. “Kiva has helped the Campus Echo staff provide a little capital to a few individuals. If you get capital in your hands, you can at least get a start in life and take it from there.”